1

Please refer to important disclosures at the end of this report

1

1

Varroc Engineering Ltd (VEL) is a tier-1 automotive component group. It designs,

manufactures and supplies exterior lighting systems, plastic & polymer components,

electricals-electronics components and precision metallic components to passenger

cars, commercial vehicles, 2W, 3W and off highway vehicle OEMs directly

worldwide. VEL has a global footprint of 36 manufacturing facilities spread across

seven countries, with six facilities for its Global Lighting business, 25 for India

business and five for Other businesses. Currently, VEL’s ~34.7% of revenue comes

from india and balance from Europe (41.8%), North America (22.3%), Asian

pacific (0.7%) and others (0.5%).

Positives: (a) Focus on high growth markets for global lighting business, (b) Focus

on increasing customer revenue for India business, (c) Continuous investment in

R&D, design, engineering and software capabilities in order to capitalize on future

trends.

Investment concerns: (a) VEL reported low consolidated top-line and bottom-line

CAGR of ~12% & ~10% respectively over FY2016-18, (b) The company’s ~35%

revenue comes from India i.e. from 2W/3W sector (which are not high growth

sectors).

Outlook & Valuation: In terms of valuations, the pre-issue P/E works out to 28.9x

FY2018 earnings (at the upper end of the issue price band), which is high

considering VEL’s historical two year CAGR top-line & bottom-line growth. Further

the company’s return ratios are also low compare to its other peers. Thus, we

recommend NEUTRAL rating on the issue.

Key Financials

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

Net Sales

6,951

8,219

9,609

10,378

% chg

-

18.2

16.9

8.0

Net Profit

17

370

303

451

% chg

-

2,100.1

(18.0)

48.6

OPM (%)

8.9

6.9

6.1

8.5

EPS (`)

1.2

27.4

22.5

33.4

P/E (x)

775.6

35.3

43.0

28.9

P/BV (x)

11.8

7.3

5.9

4.6

RoE (%)

1.5

20.7

13.8

15.8

RoCE (%)

14.5

8.7

6.9

12.8

EV/Sales (x)

2.0

1.7

1.4

1.3

EV/EBITDA (x)

22.9

24.5

23.6

15.2

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

NEUTRAL

Issue Open: June 26, 2018

Issue Close: June 28, 2018

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 85.0%

Others 15.0%

Fresh issue: Nil

Issu e Details

Face Value: `1

Present Eq. Paid up Capital: `13.5cr

Post Issu e Shareh olding Pattern

Post Eq. Paid up Capital: `13.5cr

Issue size (amount): *`1951-**1955cr

Price Band: `965-967

Lot Size: 15 shares and in multiple

thereafter

Post-issue implied mkt. cap:

*`13036cr - **`13009cr

Promoters holding Pre-Issue: 86.3%

Promoters holding Post-Issue: 85.0%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Varroc Engineering Ltd.

f

IPO Note | Auto ancillary

June 25, 2018

2

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

2

Company background

Varroc Engineering is a tier-1 automotive component group. It designs,

manufactures and supplies exterior lighting systems, plastic & polymer

components, electricals-electronics components, and precision metallic

components to passenger cars, commercial vehicles, two-wheelers, three-wheelers,

and off highway vehicle OEMs directly worldwide. It is the second largest Indian

auto component group (by consolidated revenue for FY2017) and a leading tier-1

manufacturer and supplier to Indian two-wheeler and three-wheeler OEMs.

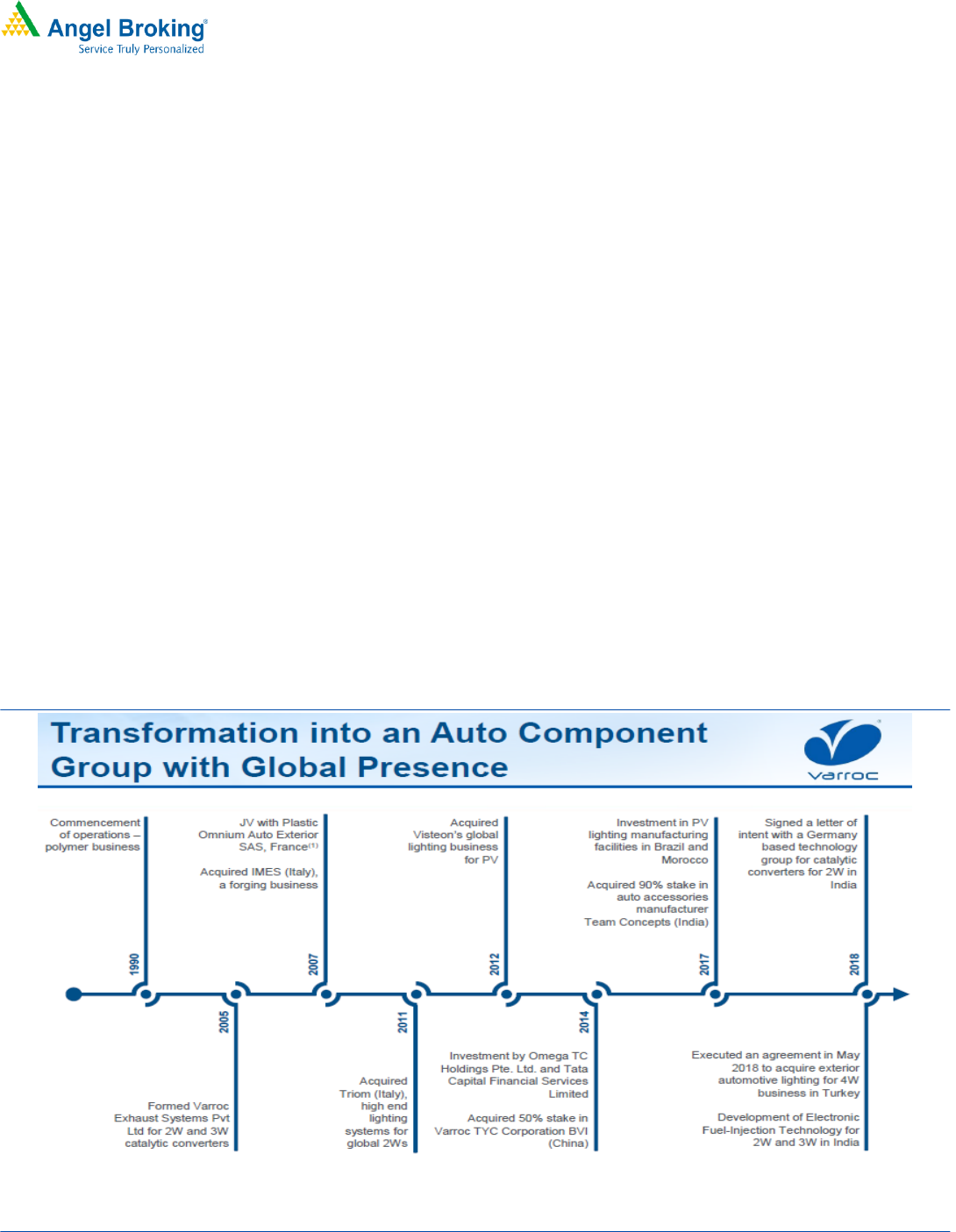

The company initially grew organically in India by adding new business lines such

as electrical division and metallic division. In 2012, it acquired Visteon's global

lighting business, now known as Varroc Lighting Systems. Prior to the acquisition of

Visteon's global lighting business, in 2007 Varroc had acquired I.M.E.S (a

manufacturer of hot steel forged parts for construction and oil and gas industries)

in Italy, and in 2011, it acquired Triom (a manufacturer of high end lighting

systems for global motorcycle OEMs) with operations in Italy, Romania and

Vietnam.

Varroc has a global footprint of 36 manufacturing facilities spread across seven

countries, with six facilities for its Global Lighting Business, 25 for India Business

and five for Other Businesses.

Exhibit 1: Transformation into an auto component group with global presence

Source: Company, Angel Research

3

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

3

Issue details

Varroc Engineering is raising `1,951-1,955cr through offer for sale of equity

shares in the price band of `965-967. Public offer of up to 2.0cr equity shares of

face value `1 each through an offer for sale of up to 1.8cr equity shares by

Omega TC Holdings Pte. Ltd. and Tata Capital Financial Services Ltd (combined)

and up to 0.2cr equity shares by Tarang Jain (Promoter Selling Shareholder).

Exhibit 2: Pre and Post IPO shareholding pattern

No of shares (Pre-issue)

%

No of shares (Post-issue)

%

Promoters

116,342,360

86.3%

114,589,800

85.0%

Others

18,469,170

13.7%

20,221,730 15.0%

134,811,530

100.0%

134,811,530

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

The objects of the Offer are to achieve the benefits of listing the Equity Shares on

the Stock Exchanges and to carry out the Offer for Sale by Selling Shareholders.

Outlook & Valuation

In terms of valuations, the pre-issue P/E works out to 28.9x FY2018 earnings

(at the upper end of the issue price band), which is high considering VEL’s

historical two year CAGR top-line & bottom-line growth. Further the company’s

return ratios are also low compare to its other peers. Thus, we recommend

NEUTRAL rating on the issue.

Key Risks

Slowdown in 2W/3W/PV industries could impact the overall sales volume

of the company

Company's ~65% revenue comes from global business, hence, any

unfavorable currency volatility could impact the company’s profitability

Increase in competition from other players can impact the company’s

business

4

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

4

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

Total operating income

6,951

8,219

9,609

10,378

% chg

18.2

16.9

8.0

Total Expenditure

6,334

7,648

9,027

9,501

Raw Material

4,193

5,049

6,037

6,383

Personnel

902

1,040

1,204

1,314

Others Expenses

1,239

1,559

1,786

1,805

EBITDA

617

571

582

878

% chg

-

(7.4)

1.9

50.8

(% of Net Sales)

8.9

6.9

6.1

8.5

Depreciation& Amortisation

254

292

337

386

EBIT

363

279

245

491

% chg

(23.2)

(12.2)

100.7

(% of Net Sales)

5.2

3.4

2.5

4.7

Interest & other Charges

475

(43)

90

86

Other Income

88

21

94

39

(% of PBT)

138.4

5.3

28.6

7.5

Share of PAT of invest acc. for using the equ. method

36

50

79

69

Exceptional Items

52

-

-

Recurring PBT

63

392

327

513

% chg

-

518.5

(16.5)

56.7

Tax

47

22

24

62

(% of PBT)

73.5

5.6

7.3

12.1

PAT (reported)

17

370

303

451

% chg

2,100.1

(18.0)

48.6

(% of Net Sales)

0.2%

4.5%

3.2%

4.3%

Basic EPS & Fully Diluted (`)

1.2

27.4

22.5

33.4

% chg

-

2,100.1

(18.0)

48.6

Source: Company, Angel Research

5

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

5

Consolidated Balance Sheet

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

SOURCES OF FUNDS

Equity Share Capital

10

26

13

13

Reserves& Surplus

1,094

1,757

2,192

2,835

Shareholders Funds

1,104

1,783

2,206

2,849

Total Loans

1,406

1,405

1,354

980

Deferred Tax Liability

64

61

31

59

Total Liabilities

2,574

3,250

3,591

3,888

APPLICATION OF FUNDS

Net Block

1,721

1,975

2,251

2,586

Capital Work-in-Progress

149

264

246

244

Investments

234

291

307

374

Goodwill

151

188

176

304

Current Assets

2,160

2,499

2,851

3,229

Inventories

586

683

753

864

Sundry Debtors

1,071

1,185

1,138

1,403

Cash

69

177

354

329

Loans & Advances

10

10

12

15

Other Assets

424

443

593

619

Current liabilities

1,855

1,996

2,269

2,965

Net Current Assets

305

502

582

265

Deferred Tax Asset

14

29

28

115

Total Assets

2,574

3,250

3,591

3,888

Source: Company, Angel Research

6

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

6

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

Profit before tax

63

392

327

513

Depreciation

254

292

337

386

Change in Working Capital

(506)

(252)

70

296

Interest / Dividend (Net)

94

81

83

85

Direct taxes paid

(57)

(40)

(51)

(124)

Others

281

(183)

(89)

(81)

Cash Flow from Operations

128

290

677

1075

(Inc.)/ Dec. in Fixed Assets

(596)

(629)

(606)

(353)

(Inc.)/ Dec. in Investments

350

50

41

(249)

Cash Flow from Investing

(245)

(579)

(565)

(601)

Issue of Equity

Inc./(Dec.) in loans

168

471

179

(437)

Dividend Paid (Incl. Tax)

(4)

(4)

(5)

(7)

Interest / Dividend (Net)

(98)

(85)

(86)

(86)

Cash Flow from Financing

70

386

94

(523)

Inc./(Dec.) in Cash

(47)

98

205

(50)

Effect of exch diff on translation of foreign

(40)

3

(11)

56

Opening Cash balances

98

11

112

305

Closing Cash balances

11

112

305

312

Source: Company, Angel Research

7

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

7

Key Ratios

Y/E March

FY2015

FY2016

FY2017

FY2018

Valuation Ratio (x)

P/E (on FDEPS)

775.6

35.3

43.0

28.9

P/CEPS

48.1

19.7

20.4

15.6

P/BV

11.8

7.3

5.9

4.6

Dividend yield (%)

0.0

0.0

0.0

0.0

EV/Sales

2.0

1.7

1.4

1.3

EV/EBITDA

22.9

24.5

23.6

15.2

EV / Total Assets

5.5

4.3

3.8

3.4

Per Share Data (`)

EPS (Basic)

1.2

27.4

22.5

33.4

EPS (fully diluted)

1.2

27.4

22.5

33.4

Cash EPS

20.1

49.1

47.5

62.1

Book Value

81.9

132.3

163.6

211.3

Returns (%)

ROCE

14.5

8.7

6.9

12.8

Angel ROIC (Pre-tax)

16.4

10.2

8.4

15.7

ROE

1.5

20.7

13.8

15.8

Turnover ratios (x)

Inventory / Sales (days)

31

30

29

30

Receivables (days)

52

54

57

70

Payables (days)

52

54

57

70

Working capital cycle (ex-cash) (days)

31

30

29

30

Source: Company, Angel Research

8

June

25,

201

Varroc Engineering | IPO Note

June 25, 2018

8

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.